How Matching Engine Software Works And Helps Execute Trades

These kinds of orders are triggered when a stock overtakes a selected price level. Beyond this worth level, stop orders are changed into market orders and executed at one of the best value out there. TeraExchange was unable to scale and innovate with their existing provider’s solution. Connamara labored with the trade to construct and launch a future-proofed SEF with state-of-the-art self-healing capabilities that enable the exchange for scalability. Integrate EP3 with third-party or proprietary market entry and trading functions.

Our meticulous Discovery process ensures an in-depth understanding of your unique requirements, setting the stage for a easy EP3 implementation — tailor-made for you. Developing a strong and safe trade infrastructure includes advanced technical challenges, requiring expertise in areas such as structure design, software program improvement, and cybersecurity. Additionally, building means starting from floor zero, leading to a prolonged development timeline. This can considerably delay your entry into the market, giving opponents utilizing ready-made options a head begin. Building an trade from scratch could be an attractive prospect for companies that need full ownership and management over their technology. In fact, some start-up exchanges believe that proudly owning their infrastructure can improve their ability to draw traders and differentiate themselves in the market.

The order matching system is the core of all electronic exchanges and are used to execute orders from members in the change. Matching orders is the method that a securities exchange makes use of to pair one or more buy orders to a number of sell orders to make trades. The task of pairing the orders is computerised through an identical engine which prioritises orders for matching. Upgrade to a contemporary trade platform and tech stack, substitute outdated know-how, take your trade to the cloud, or accelerate your expansion into non-traditional markets.

Powerful, flexible, and simply scalable, EP3 comes out of the box with all the capabilities a contemporary change requires. We provide custom software program improvement companies to assist you meet your operational and enterprise goals. The EP3 Admin UI allows exchange operators to handle and configure their markets and provides market monitoring, auditing and reporting capabilities.

American Monetary Change (afx)

Right off the bat, it’s important to know which asset lessons your buying and selling venue will be offering. In this article, we’ll provide you with an perception into what an order matching engine is, the mechanics behind it, and what to pay attention crypto exchange engine to when choosing one for your trade or dark pool. Once a matched order is crammed by way of cancellation, fulfillment, or expiration, the party that submitted the order receives a notification.

The info distributed by this service just isn’t personalized, and there’s no approach to hyperlink occasions from the Market Data Feed to a particular market participant. Finally, we now have user-facing administration software program for monitoring and manually intervening when needed. This brings us to connectivity protocols, which deliver collectively different components of the change infrastructure and allow it to connect to external third parties. Find out if a potential provider can offer these, or whether they have a roadmap in place for including this performance at a later date. The commerce is completed as soon as two orders match, and all events involved are notified.

Complex Challenges, Pricey Solution

An choice for property which allows for the control of financial operations by the use of limitation of deposit and withdrawal rights through the admin panel. An progressive type of professional software program which helps brokers and exchanges deal with their prospects, admins and IB-partners beneath one roof. We can join you via Marksman Hub to essentially the most trusted and well-known spot exchanges offering the highest liquidity and that are most dependable out there such as B2BX Exchange.

novice to pro-traders. In this ultimate guide is designed to help you through the method – from concept inception to manufacturing and past – that can help you get to the first commerce quicker. Two of crucial decisions on the journey to upgrading or establishing a new change are understanding the out there technology and choosing the proper trade know-how companion.

- The trade is completed as quickly as two orders match, and all events concerned are notified.

- This enchancment launched an period where anyone can trade nearly any asset from the comfort of their home.

- The most common is the centralized matching engine, which most main exchanges use.

- This degree of pace permits for faster execution of trades, making it suitable for high-frequency trading methods that require near-zero latency.

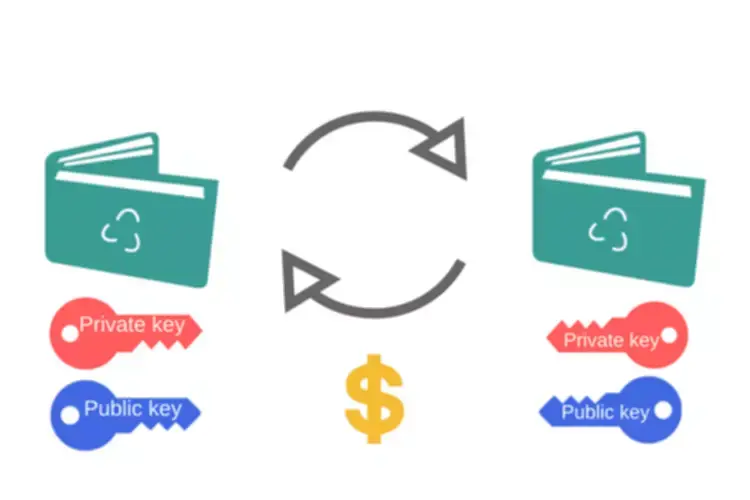

Just like you possibly can tell from the name, a commerce matching engine matches purchase and sell orders performed in an electronic buying and selling community. A dependable order-matching algorithm can remedy many issues arising in exchanges due to its quite a few benefits. However, there are also some challenges that trading platforms might encounter when using OMEs. The decentralised match system is a system that matches orders from a number of customers in actual time and not utilizing a central server, utilizing a peer-to-peer community. This eliminates a single point of failure and increases security against assaults. With predefined algorithms dictating order precedence, matching engines uphold fairness, promoting transparency in trade execution.

It is essential to make a careful determination in relation to selecting the correct pairing engine, requiring careful deliberation on numerous elements. We use AWS resolution and supply full help and maintenance of the servers. Enterprise wallets solutions that offer your clients Bitcoin, Ether, Ripple`s XRP, Bitcoin Cash, Litecoin and more as a cost choice. Set up your own Apple Store developer account or opt for our ready-made account so your customers will have the ability to find an iOS software

Vs Brokerage Platform

Understanding their operate and significance is essential for each market participant. Decentralized matching engines function on a peer-to-peer community, providing resilience in opposition to attacks. While they contribute to a safer trading setting, they may sacrifice some speed and effectivity in comparison with their centralized counterparts.

They are designed to match buy and promote orders in real-time, so transactions could be executed shortly and efficiently. There are many various algorithms that can be utilized to match orders, but the commonest is the first-come, first-serve algorithm. This signifies that the orders are matched in the order in which they are received.

Complementary Companies From Our Experts

EP3 is ready that can help you shape the shopping for and promoting dynamics of your new market. This website is utilizing a security service to protect itself from online assaults. There are a quantity of actions that would set off this block including submitting a sure word or phrase, a SQL command or malformed knowledge. A host of add-on integrations, custom growth work, and assist providers from our buying and selling and expertise experts ship complete front-to-back capabilities. Theorem empowers you to give consideration to commerce execution by streamlining your post-trade processes and generating actionable insights. We need to enable large financial institutions the ability to commerce cryptocurrencies with full confidence and trust, while providing retail traders an equivalent secure framework.

Matching Engine: What Is And How Does It Work?

The charge construction is one other issue to consider when selecting a matching engine. It is value considering the engine’s pace before you decide to make use of an trade. This guide will outline commerce matching, explain why it is required, determine greatest practices in the matching course of, and focus on tips on how to efficiently use its outputs. The processes described apply to both large firms with high buying and selling volumes and smaller operations with lighter trading exercise as counterparties and shoppers count on a course of that is free from errors. The algorithm applied by the matching engine is the vital thing component in what behaviour we need to incentivize in the exchange.

Real-Time Data – The match engines have a built-in knowledge server, enabling you to energy desktops and apps. This allows you to stream data to users on trading software program and desktop platforms, enabling them to access information immediately from the net and through the applying. Moreover, an OME is crucial for offering https://www.xcritical.in/ liquidity, enabling traders to buy or sell assets without continually in search of a purchaser or vendor. It ensures there is all the time somebody to buy or promote an asset, even at unfavourable prices, making buying and selling simpler and promoting market stability.

OMEs range in their key options, but core features are comparable for many of them.

The three largest futures match engines by contract volume are the CME Group’s Globex platform, NYSE Euronext’s Liffe Connect and Eurex’s 10.zero system launch. Many main consultants in the field carried out studies about orders prioritization and allocation. But that is contradicted by the reality that a pro-rata system, in some instances, has led to a reduction in market depth and a big reduction in liquidity available.

Pro-Rata is a different set of matching guidelines under which the matching algorithm prioritizes larger orders, offering them with a proportionally larger share of the obtainable liquidity at a given worth stage. We’ve already mentioned the order e-book, which is among the major parts of a matching engine. At the center of it all we have the matching algorithm, which performs most of the heavy lifting in relation to order execution. Transparency of trading – A match system improves transparency within the monetary market by providing equal access to buy and promote order knowledge, leading to more correct value determination. The article will define matching engines’ functionality advantages and downsides.